tl;dr;

We've built a five-step method to spot tech trends worth betting on. It mixes data, gut feel, and our team's strengths to find opportunities that actually matter. Here's how we do it.

Why we need a system

The tech world never stops moving. One day it's DeFAI (AI-driven DeFi), the next it's spatial computing. Pick the right trend and you're golden. Chase every shiny thing and you'll waste time and money.

We needed a way to make smart bets. Something that aligns new opportunities with what we're good at and the four things we care about: boosting productivity, building communities, engineering liquidity, and creating IP. This is how we figured it out.

Our five-step approach

We've tested this method on everything from Golang to blockchain. It balances hard data with experience, and it works for a scrappy consulting team like ours.

1. Spot the pulse

We start by finding tech "pulses" - early signals that something big might be coming. This isn't just guessing. We use both data and instinct.

What we look for:

- Hiring trends and funding news from our growth engine

- Chatter on X and in VC reports

- What the smart folks are building in niche communities

Take DeFAI. We saw $500M flowing into AI-blockchain startups in 2024. Then we noticed DeFi developers on X talking about LLM-driven interfaces. That's a pulse worth exploring.

How it works: We scan for stuff that solves real problems or could shake up markets. Cross-reference the numbers (like 10x growth in DeFAI usage) with what people are actually saying.

2. Dig into the tech

Once we spot something interesting, we dive deep. We need to understand what makes it tick and where it might break.

Our analysis covers:

- Where it came from: Why did this tech emerge? For DeFAI, it's DeFi's $180B market hitting LLM breakthroughs post-2020. People wanted better UX and automation.

- How it works: The nuts and bolts. Smart contracts in Solidity, consensus mechanisms, AI compute platforms like Bittensor.

- What it does well: DeFAI nails UX and automation efficiency.

- What it sucks at: High compute costs and transparency issues.

- Biggest challenges: Scalability and security for AI models.

- Real limitations: Still mostly appeals to crypto folks.

Why this matters: Understanding the mechanics helps us spot real opportunities versus hype. For DeFAI, we learned it simplifies DeFi but costs about $50,000 per LLM model to train.

3. Find the right people and industries

Not every trend works everywhere. We focus on industries and people where the tech can actually create value, especially in our four verticals.

How we choose:

- Market size and growth potential

- Where our network reaches

- Alignment with our strengths

For DeFAI, we targeted finance folks (DeFi developers), tech teams (blockchain engineers), retailers (e-commerce platforms), real estate (tokenization), and healthcare IT.

The key: We identify specific pain points these people have. High payment fees for retailers. Complex development for engineers. Stuff the new tech can actually fix.

4. Match solutions to problems

Here's where we connect what the tech can do with what people actually need. We explore both user-facing apps and developer tools.

Our approach:

- Test it ourselves first to build expertise

- Map capabilities to pain points for each target group

For DeFAI, we used AI-integrated smart contracts for our own treasury management. Then we brainstormed how LLM-driven interfaces could help retailers accept crypto payments more easily.

What this gives us: Real hypotheses about where we can create value. Like mapping AI oracles to finance developers who need real-time data feeds.

5. Generate ideas and make plans

Time to get creative, then get practical. We come up with solutions, pick the best ones, and plan how to build them.

Our process:

- Brainstorm: 3-5 high-impact solutions per industry, both apps and infrastructure

- Filter: Evaluate based on revenue potential, strategic fit, and how hard it is to build

- Plan: Outline objectives, features, and steps, starting with MVPs

For DeFAI, we proposed an AI investment app (for users) and a smart contract AI integration kit (for developers). We prioritized the developer kit because it fits our strengths and has clear market demand.

The result: Actionable projects we can actually execute. Like our smart contract kit with LLM integration, tested on Arbitrum.

How we built this method

This didn't happen overnight. We learned from years of betting on tech trends, some good, some not so much.

Early days: We started with gut feelings. Mobile apps in the 2010s, Golang adoption. When we combined data (hiring trends) with community signals, we did well.

Learning from mistakes: Bets like Fuchsia OS and Elixir didn't work out. Wrong timing, poor market fit. Taught us to check if the ecosystem is actually ready.

Refining with DeFAI: Analyzing AI + DeFi in 2025 helped us nail down our approach. We added the origin layer to understand why trends emerge. Started focusing more on infrastructure solutions to use our technical skills.

Constant improvement: Every thesis teaches us something. Golang's community-driven success showed us to watch social signals. DeFAI confirmed we need both technical depth and balanced thinking about apps versus infrastructure.

The method crystallized into something structured but flexible. Data plus intuition plus strategic alignment with what we're good at.

How it works: The DeFAI example

Let's walk through how we applied this to DeFAI:

- Spotted the pulse: $500M in AI-blockchain funding plus X chatter about LLM-driven DeFi interfaces

- Analyzed the tech: Studied how DeFi's UX problems meet AI advances, strengths (automation), weaknesses (cost)

- Found our people: DeFi developers, retailers, healthcare IT teams aligned with our productivity and liquidity focus

- Mapped solutions: Matched DeFAI to real problems like complex development (solved by AI SDKs) and high payment fees (solved by layer-2 AI payments)

- Made plans: Proposed specific solutions like an AI investment app and smart contract AI kit, with MVPs to test internally first

This positioned us to tap into DeFAI's projected $10B market by 2025 with stuff we can actually build.

Why this works

Our method succeeds because it's:

- Smart about data: Uses hard numbers plus experience to spot early trends

- Strategically aligned: Ties everything back to our four verticals

- Resource-conscious: Focuses on high-impact, doable solutions for a small team

- Always learning: Gets better with each bet we make

What's next

We're testing this approach on spatial computing and advanced AI automation. By trying things internally first and sticking to our strengths, we'll keep building solutions that matter.

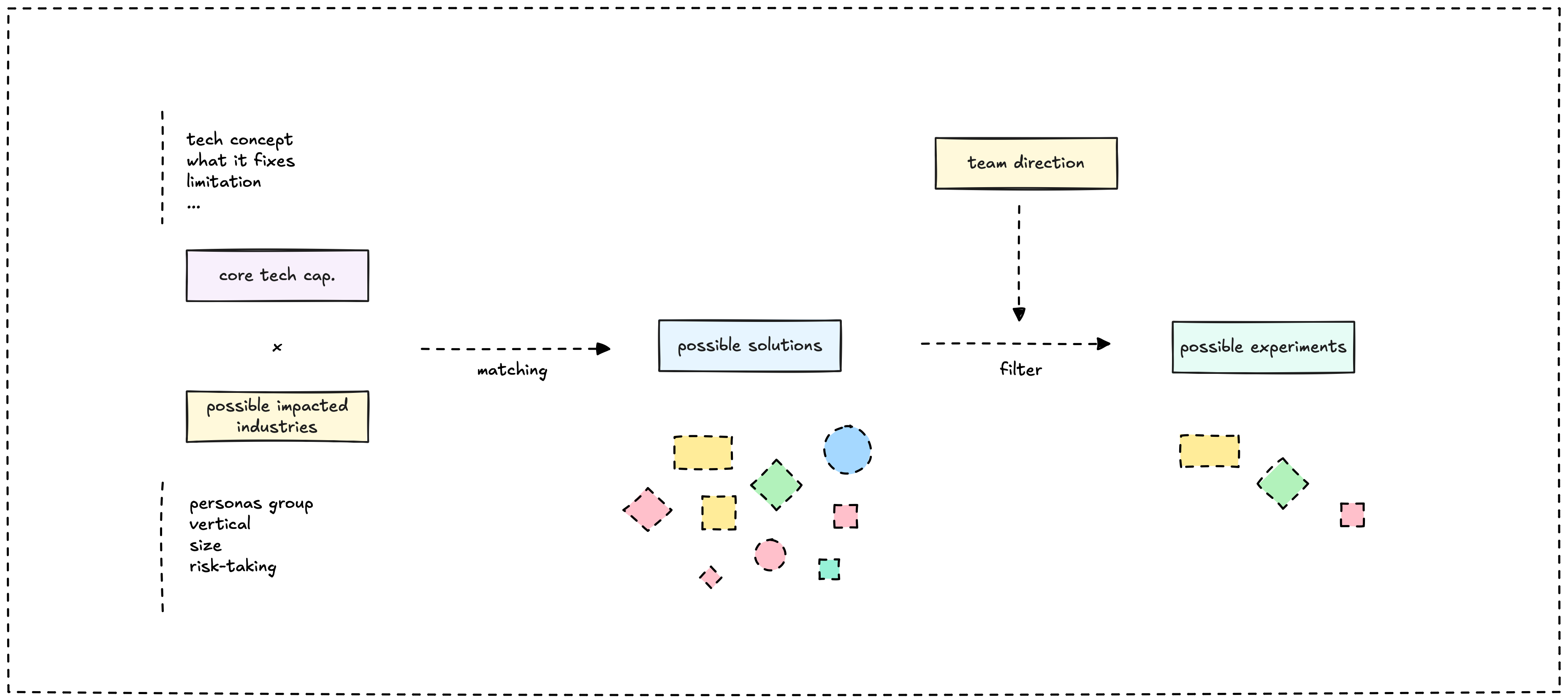

This methodology helps us build solid assumptions about what to create in our arc series, where we explore specific tech trends and their potential applications. Once we have these assumptions, we use our experiment selection framework to choose which ideas to actually build.

Next: Choose what to build or Test the water